Having an FHA mortgage, you will need to establish at the very least step 3

Protection

/cdn.vox-cdn.com/uploads/chorus_image/image/49521721/paypal_paydiant_recode.0.jpg)

- With a great doors, windows, hair, and other security measures set up

- Making sure the fresh new roofing prevents water and does not exceed around three levels

Ensuring Features Fulfill FHA Conditions

- Assessment Techniques: An FHA-approved appraiser monitors the house to find out if it match FHA’s statutes.

- Lender’s Role: Loan providers hire an appraiser to check when your house suits FHA requirements. If they get a hold of troubles, the lending company could possibly get require repairs prior to approving the loan.

- Called for Repairs: If you can find things, it’s to the consumer to locate them fixed through to the mortgage goes through.

Property Requirements to have FHA Money

- Top Quarters: FHA loans was having homes you want to reside in because most of your residence. You cannot play with an FHA financing for the second home in the event the you already have you to definitely since your number 1 house. Imagine bringing a Virtual assistant loan or domestic collateral mortgage out-of RenoFi while you are wanting financing a moment house.

- FHA-Accepted Appraiser: Merely an appraiser approved by FHA will be take a look at assets. This will make sure the lending company knows our home meets all the FHA financing laws and regulations.

- Defense Have a look at: Ensure that the home suits HUD’s protection and you may assets requirements. It have one thing safe and right as to what FHA requires.

Just how to Be eligible for FHA Financing

Given that we’ve replied issue Must i purchase a home at public auction having a keen FHA financing? and secured the house guidance, let us look at the requirements you should see purchasing a foreclosed home with it mortgage.

Credit rating

Basically, you need a credit history of at least 580 to find a keen FHA financing towards the lowest deposit. In the event the rating is between 500 and you may 579, you may still be considered, but you’ll need to make increased advance payment.

Advance payment

5% of one’s price when your credit score try 580 otherwise high. If your rating is leaner, you will need to get off as much as 10%.

Debt-to-Income Proportion

The debt-to-money (DTI) ratio will be essentially be 43% or lower. Particular lenders you will let you has actually increased proportion for many who has actually most other good stuff opting for you, for example a huge checking account or a top credit rating.

Regular Earnings and you can Work

You will want to make suggestions enjoys a stable income and you will a beneficial jobs. Loan providers always like to see you’ve been employed continuously getting at least 24 months, preferably with similar employer.

Mortgage Insurance policies

You will want financial insurance rates to locate FHA fund. It indicates using an initial financial insurance premium (UFMIP) of 1.75% of your own loan amount, in addition to a month-to-month financial insurance premium (MIP).

Loan Constraints

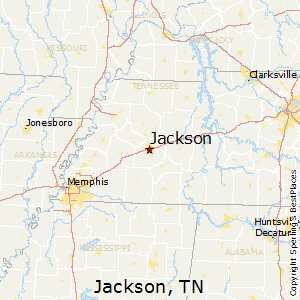

FHA loan limitations vary based on in your geographical area, the sort of family we should financing, therefore the cost of living close by. Make sure the cost of the new foreclosed house drops inside the FHA loan constraints to suit loans in Firestone your city. You can utilize the latest Institution of Construction and you may Urban Development (HUD)is why online lookup equipment to check the loan limit on your own condition or county.

No Recent Bankruptcies or Foreclosed Property

You need a clean financial history for the past lifetime. Always, you ought to wait no less than 24 months immediately following a bankruptcy proceeding release and you will 36 months after a property foreclosure to be eligible for an FHA loan.

Advantages of FHA Loans

- Reduced Downpayment: You might be eligible for an FHA financing with a downpayment only step three.5%. This might be beneficial without having an enormous contribution stored to have a deposit.

- Versatile Borrowing from the bank Standards: FHA finance be easy that have credit ratings compared to old-fashioned finance. It means you’ll be able to qualify for the mortgage, regardless of if their credit ratings commonly primary.

Comentários